December 7, 2023

U.S. and U.K. seek to reduce dependence on electric vehicle battery imports through large investments in domestic battery production and supply chains

The U.S. and U.K. governments have released national strategies and announced billions in available grants for developing large-scale battery plants that can support their respective auto industries as they electrify their fleets.

On Nov. 26, the U.K. government released its first-ever Battery Strategy, a 69-page blueprint document that will authorize the release of over £2 billion in new capital and R&D funding to support the manufacture and development of zero emission vehicles, their batteries, and supply chain from 2025 to 2030. This follows an announcement of £4.5 billion to be invested in funding British manufacturing from the autumn statement, of which £2 bn was earmarked to support the automotive industry in reaching net zero.

Just weeks earlier, on Nov. 16 the U.S. Department of Energy announced $3.5 billion in grants to boost domestic production and recycling capabilities for advanced batteries and related components and materials.

Both countries' battery strategies are intended to reduce dependence on electric vehicle battery and battery pack imports from Asia, where over 1,000 battery plants are currently in operation. In North America, 30 planned battery factories are being built across the U.S. and Canada. Currently, the U.K. has one large-scale battery factory in operation and two more gigafactories planned after recent announcements by AESC and Tata Agratas.

A £2B U.K. Battery Strategy prioritizes local design and manufacture of EV batteries

The U.K. Battery Strategy was crafted with the input of 84 EV manufacturers, investors, and battery designers. The strategy document outlines how the U.K.'s Department for Business and Trade will support the growth of a domestic battery industry, including a globally competitive battery supply chain, by 2030.

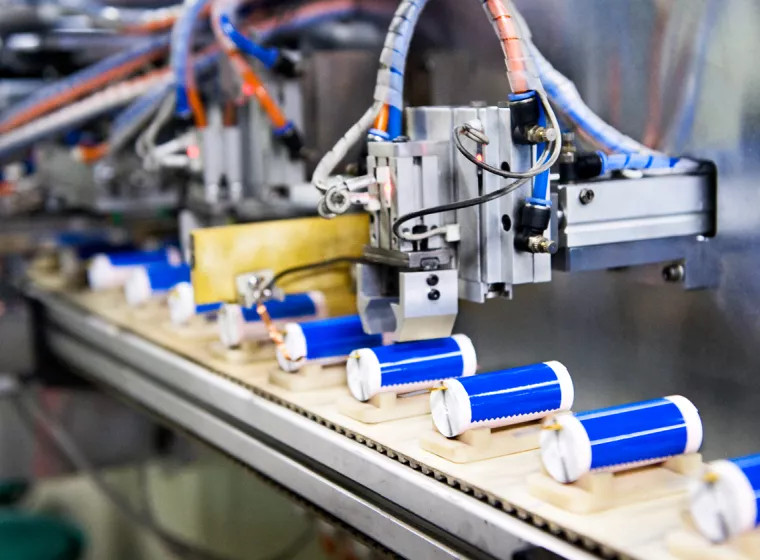

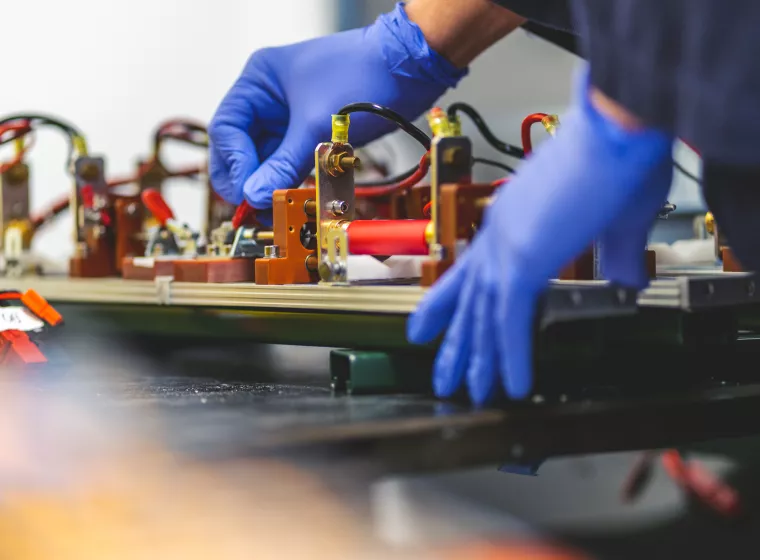

Over the next five years, the Battery Strategy's £2 billion in new grants will support operations such as lithium and chemical processing, battery design, workforce development, recycling operations, and automotive manufacturing.

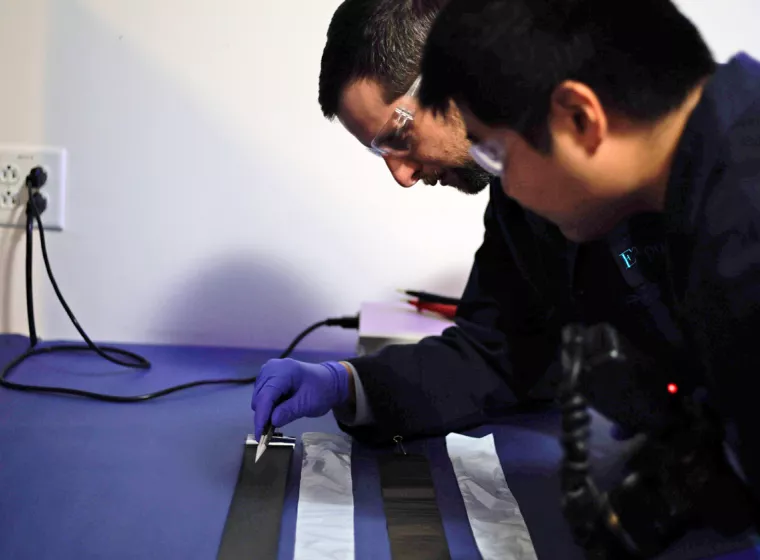

In addition, the document authorizes an additional £38 million for the U.K. Battery Industrialisation Centre to develop new chemistries and technologies and £12 million for the Advanced Materials Battery Industrialisation Centre to build know-how in lithium-ion solutions. The strategy will also authorize the investment of £11 million in 20 competition winners developing startup technologies across the battery value chain in areas such as artificial intelligence and digital tools to increase battery performance, alternative chemistries, and improved recycling technologies.

This funding is in addition to the £2 billion allocated in the recent U.K. Autumn Budget to support the U.K. automotive sector in reaching its net zero goals.

U.S. Department of Energy grants focus on materials, battery production, and recycling

In the U.S., the DOE grant program works by backing half the cost of establishing, retrofitting, or expanding operations for battery component production, precursor manufacturing, lithium recycling, or mining of rare earth metals. This second round of funding, administered by the DOE's Office of Manufacturing and Energy Supply Chains (MESC), will specifically focus on the extraction and development of raw materials for batteries alongside battery manufacturing and recycling.

A 141-page document on the DOE's Infrastructure Exchange website describes the specific requirements of the grant and funding applications in detail. Initial concept papers are due to DOE by Jan. 9, 2024. Full applications must be submitted by March 19, 2024.

The DOE will carry out four funding rounds for this initiative, with a minimum federal award of $50 million and a maximum of $300 million. Funded applications will be announced in August 2024.

This $3.5 billion announcement from the DOE is the second part of a $6 billion-plus program. Last year, the first phase funded 15 projects involving companies that mine critical minerals like graphite and nickel used in lithium batteries.

The federal funding aims to boost domestic battery supply chains and reduce dependency on imported sources of critical minerals. According to the International Energy Agency, the U.S. accounts for 10% of EV production and 7% of battery production globally.

What Can We Help You Solve?

Our team of environmental, materials, and thermal scientists and engineers have the expertise to help clients manage lithium-ion batteries safely, sustainably, and cost-effectively through each stage of their lifecycle. We provide solutions to the multiple regulatory and technical challenges involved in battery design, collection, transport, disassembly, disposal, and recycling.

Insights